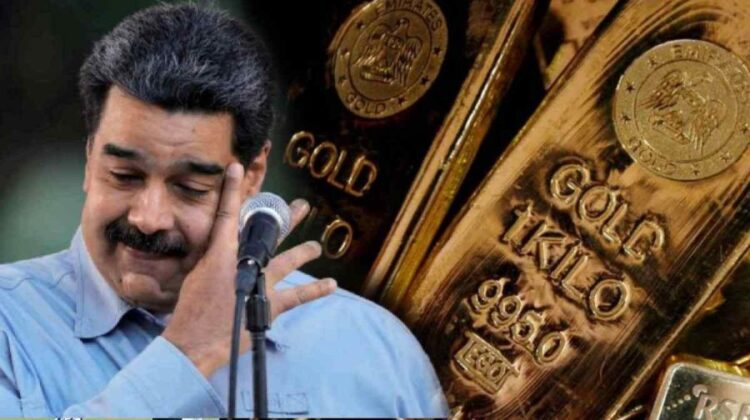

Following the US detention of Venezuelan President Nicolás Maduro, investors’ worries about geopolitical threats have led to a surge in the price of precious metals. Gold was up 1.8% at $4,408 (£3,282) an ounce during Monday morning trading in Asia, while silver was up nearly 3.5% as investors shifted their money into so-called “safe-haven” assets.

In the meantime, share prices in the area were generally higher and crude oil prices barely changed. In 2025, both gold and silver reached all-time highs before declining in the final days of the year. Gold had its best yearly performance since 1979 despite a decline at the conclusion of the previous year. It had risen by more than 60%, hitting a record high of $4,549.71 on December 26.

Expectations of further interest rate cuts, significant central bank purchases of gold, and market worries about international tensions and economic uncertainties were some of the factors driving those advances. As investors considered how Washington’s intervention in Venezuela may impact crude supplies, oil prices fluctuated during early trading and were slightly lower by midmorning.

Also Read:

Jack Smith’s Testimony Regarding Trump Prosecutions is Made Public by Congress

Toni Moral: Reshaping Perspectives around Bitcoin in a Fun Way with Supermultiverse