Experience and Expertise in identifying investing trends

Paul Gill is the principal of Future Opportunities, a company dedicated to supporting growth-stage organizations in determining and implementing the right structure, approach and opportunities for future success. With a focus on minerals and resources, robotics and automation, technology and more, Future Opportunities is focused on becoming a trusted partner to identify the areas for organizational improvement and optimization for public and soon to be public companies.

Beyond organizational support and advice, Future Opportunities is also an experienced guide for investors looking to understand a range of sectors.

Paul has a history of success in identifying, establishing, promoting and developing mining projects, such as Canadian Norsemont Metal’s* Constancia copper mine in Peru from 2003 to 2011. He learned what factors to look for in a project to predict and ensure success. During his tenure with the company, Norsemont’s share value grew from $0.05 to $4.00 with continued renewal of management, proving his vision and ability to work within a team environment to achieve a goal.

While Paul’s knowledge, insight and experience make him an asset to the companies he supports, he recognized he couldn’t lead every organization he became involved in. He learned to take a step back while still delivering valuable guidance, connections and resources as a consultant through Future Opportunities.

CONSTANCIA PROJECT – HUDBAY BOUGHT NORSEMONT FOR THIS PROJECT

*Norsemont Metals was sold in 2011 to Hudbay Minerals for $512 million.

His philosophy of “work hard, then work smarter” stems from Paul’s background growing up with his Canadian-immigrant parents on a hobby farm in the Lower Mainland of British Columbia, Canada. The daily farm work helped him appreciate not only the value of work but also the value of his opportunities.

After completing post-secondary school and a stint in the public sector working with provincial and federal governments for 10 years, he saw the potential in helping companies in public markets rebuild and excel.

Norsemont was one of his first successes in the resource sector. It was successfully sold to Hudbay Minerals for $512 million. The investors saw a massive return on investment in this company. Here Paul guided and advised the company through this acquisition.

Fast Forward to the present time and Lomiko Metals, is now funded by both the US and Canadian governments.

Through Future Opportunities, Paul strives to provide organizations with the support and insight into resources that will help them flourish and arm investors with the information they need to make educated decisions. While his successes prove he knows the industries he specializes in, it’s his commitment to understanding the position of a project and its potential that allows him to support organizations in a way that few others can.

The challenge: EV battery resources – finding the right project leads to Lomiko

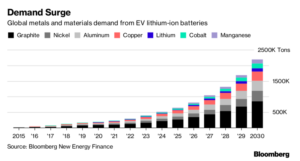

Appreciating the potential in the electric vehicle market and the growing need for their battery components, Paul leveraged his experiences from building Norsemont into a greener space. He’d witnessed market demands for copper, increased the value of the Peru mine, aimed to cultivate lithium and graphite projects that would flourish due to the need for lithium-ion battery materials in the promising EV market. He’d identified the materials of choice, but where to find the best project?

A global view drove Paul to choose several properties around the world. His expertise then helped him narrow these options for Lomiko Metals, a company he co-founded in 2008 and served as CEO until 2023.

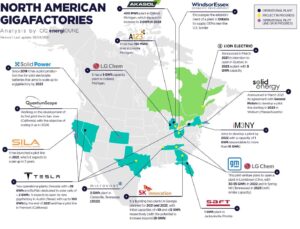

During development, Not only did Paul need to find the right projects to supply raw materials, but he also needed to support the burgeoning growth of Lomiko so that the company could keep pace with anticipated demand. EV Battery factories in the hundreds were under development in 2009 and graphite and lithium (at a 15:1 ratio) are crucial components to battery creation, but with only 25 to 30 operational graphite mines, the opportunity was obvious. The challenge was building Lomiko Metals sustainably for the long term to continuously support the EV market.

The secondary challenge was ensuring investor engagement, which, during the lengthy process of production, can be incredibly difficult.

The process: Finding and establishing Lomiko Metals’ La Loutre project

Dividing time between lithium and graphite exploration during Lomiko’s formation was a fool’s errand as it would split project resources and could potentially strain both streams. While finding a lithium project would come in time, Paul decided that graphite was the better choice initially, based on several factors:

- With hundreds of EV factories in development and little more than a couple dozen graphite mines, there was a nearly tenfold need for more mines considering each battery manufacturing plant requires nearly the complete output from one mine.

- Lithium degrades, as Paul says, it has a “shelf life” which puts factories in a pinch if they need to use the lithium but don’t have the graphite to go with it.

- Lithium may be the higher sale-point resource, but at a 15:1 ratio of graphite to lithium in a lithium-ion battery, the volume makes up for it.

- Graphite makes up 95% of an EV lithium-ion battery’s anode.

- Graphite takes up the most mass of the minerals in a lithium-ion EV battery, so transportation to the processing plant must be minimized.

- Trade wars with China (which exports more than 90% of the world’s graphite) mean a domestic source of graphite is a superior choice.

- The market for EV vehicles is expected to increase more than tenfold from 11.3 million in 2020 to 144.3 million in 2030.

Finding like-minded individuals to invest as a group in the future of Lomiko Metals was one of Paul’s ongoing goals and with the strength of the demand story for graphite, the positioning was easy. Education and involvement were key from the start. A pivotal moment arrived in 2010 when social media gave AJS Management (the forerunner of Future Opportunities) the ability to find and connect with these like-minded individuals. Long-term relationships with entrepreneurs and investors came as a result.

With early investment commitments in place, Lomiko Metals sought to find a world-class property that could become a steady supplier of EV battery materials. The objective was to create a 20-year mine that could produce 10 million tonnes or more of graphite at 5% grade.

After exploring and discarding several projects that didn’t fit the criteria, Paul and the team homed in on Quebec, Canada as a possible location. He connected with the Critical Elements Chair, J.S. Lavallee, to option a site 117 km northwest of Montreal, called La Loutre. This process took vision and patience, but eventually, it was clear that the project had excellent economic potential. Assessing the long-term viability of La Loutre, which consists of 42 mineral claims over 25 sq. km, began.

La Loutre was identified as having excellent potential for a variety of reasons:

- Near-surface mineralization and good metallurgy, which would allow for obtaining graphite at a significant rate

- Accessibility to infrastructure – La Loutre was close to highways which made access to hydropower and a local workforce possible – just 45 km from Mont-Tremblant.

- Drilling intercepts found more than 100 meters of 14% graphite in one of the holes with other significant intercepts surrounding it

- Other graphite projects were relatively close to the La Loutre site

- The province of Quebec is a savvy mining partner that supports projects like La Loutre

- Located in a stable jurisdiction with access to clean energy

As the project grew in success and scope, Paul expanded the Lomiko Metals team to ensure leadership would take the La Loutre project and others forward with confidence and commitment.

Investor Engagement:

Keeping investors involved in Lomiko Metals activities was key to maintaining optimism and attracting more funds. This was achieved through acquisition of interests in other companies and activities related to battery resourcing projects.

First, Lomiko purchased 25% of subsidiary SHD Smart Home Devices Corporate which was an innovative IT device. Then, in 2018, Prometheus Technologies was launched to work in conjunction with SHD and Graphene 3D Labs.

Results: La Loutre graphite by the numbers

While the La Loutre project site was obtained by Lomiko in 2016, mining of this nature is a long game and Paul knew to keep his eyes on the ongoing successes that pointed to the company’s positive future.

In 2021, La Loutre received its positive preliminary economic assessment (PEA) indicating the potential of the project. It was the first of many triumphs to come over the subsequent three years, built on Paul’s leadership and skills. In the same year, just 100 km from the La Loutre site, Lion Electric built a lithium-ion battery factory with support from the government of Canada.

The summer 2022 drilling had positive results. La Loutre mineral resources were estimated to have a 15-year life span with annual production of 97,400 tonnes of graphite concentrate totaling 1.4 million tonnes over the life of the open pit mine. Mining.com identified La Loutre as the 7th largest graphite deposit worldwide. There are two key deposit zones under exploration at the site.

Costs for the site were estimated at an average of US $406 per tonne with initial capital costs at $187.1 million CAD and $29.8 million CAD for ongoing capital costs over the project’s life. At the time, the 15-year outlook for graphite prices is $917/tonne making is a viable project. Based on this, the estimated payback period is calculated at about four years.

Receiving the ECOLOGO certification for mineral exploration in March 2022 was another highlight showcasing the organization’s desire to stay true to its origins of sustainability and positive outcomes on all measures. Subsequent studies showed this graphite meets or exceeds industry standards.

Knowing the organization was in good hands and on the path of success, Paul stepped down from his role as Chair in Nov 2023. His work paved the way for the organization’s biggest victory when both US and Canadian funding was announced in May 2024.

The US Department of Defense committed $8.35 million USD (11.2 CAD) towards feasibility studies, environmental studies and metallurgical studies. Natural Resources Canada provided $4.9 million CAD for lab work to refine the upgrading processes. These funds are part of the joint Canada-US Energy Transformation Task Force.

Future: Shaping tomorrow’s resource businesses and supporting investors

The key to success for any public company is to attract loyal investors who establish a core position in the company or, at the very least, have an ongoing interest and enthusiasm for it. Keeping them informed aids in this process and when the time is right, they will be galvanized into action when there is an opportunity to make shared gains.

Technology and mining companies need investors, influencers and research followers to ensure organizational strength. This is where Future Opportunities excels. Attracting the right investors, contacts and resources is one of Paul’s personal assets and through Future Opportunities, he brings experienced strategy, advising and communication to the role of secure and confidential confidant to C-suite executives and Investor Relations teams.

In the next 10 years, Benchmark Minerals Intelligence indicates that North America must build 50 new graphite mines and reshore semiconductors and other technological investments. These areas are the focus of Future Opportunities: to identify and collaborate with great companies and assist them in attracting followers and investors.

Follow Amrit Paul Singh Gill on LinkedIn.

Find Future Opportunities on LinkedIn and visit their website www.future-opportunities.com to learn more about it here.

READ MORE –

Stay Ahead With Intelligent Tech Solutions with the CEO of “Nex Information Technology”: Indraanil Choudhuri

Insights from Von Poll Greece with Ms Natalie Leontaraki: Traditional Values, Expertise, and Client-Centric Service in Real Estate