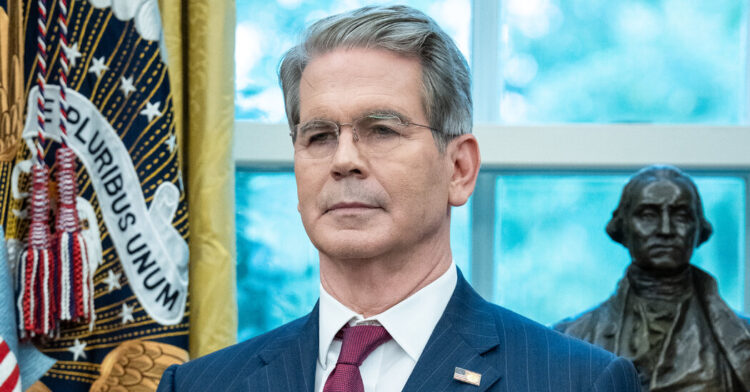

The US Treasury, led by Scott Bessent, has taken on a high-stakes role in supporting Argentina amid a sharp decline in its currency, the peso, with the White House stepping in to stabilize the situation. In September 2025, fearing economic collapse could threaten ally President Javier Milei and his political party ahead of crucial midterm elections, the US arranged a $20 billion currency swap allowing Argentina’s central bank access to dollars, alongside direct purchases of pesos to prop up the currency.

Politically, the intervention paid off: Milei’s party avoided losses and made gains in the elections, strengthening his position. Yet financially, the results remain uncertain. Despite the US support, the peso has depreciated roughly 30% this year, including a 4% drop in the month following the elections, underscoring persistent economic risks. There is concern the US might end up holding devalued pesos.

This bailout is unusual for a White House stance normally focused on “America First” and for its rare direct financial involvement in an emerging-market currency. Milei’s pro-market reforms and spending cuts have gained favour with US conservatives, with Trump calling Milei his “favourite president.

Also Read:

Marjanae Truesdale: Transforming Love through Awareness and Spiritual Intuition

Professor Paul Robert Vogt: A Global Mission to Transform Heart Surgery